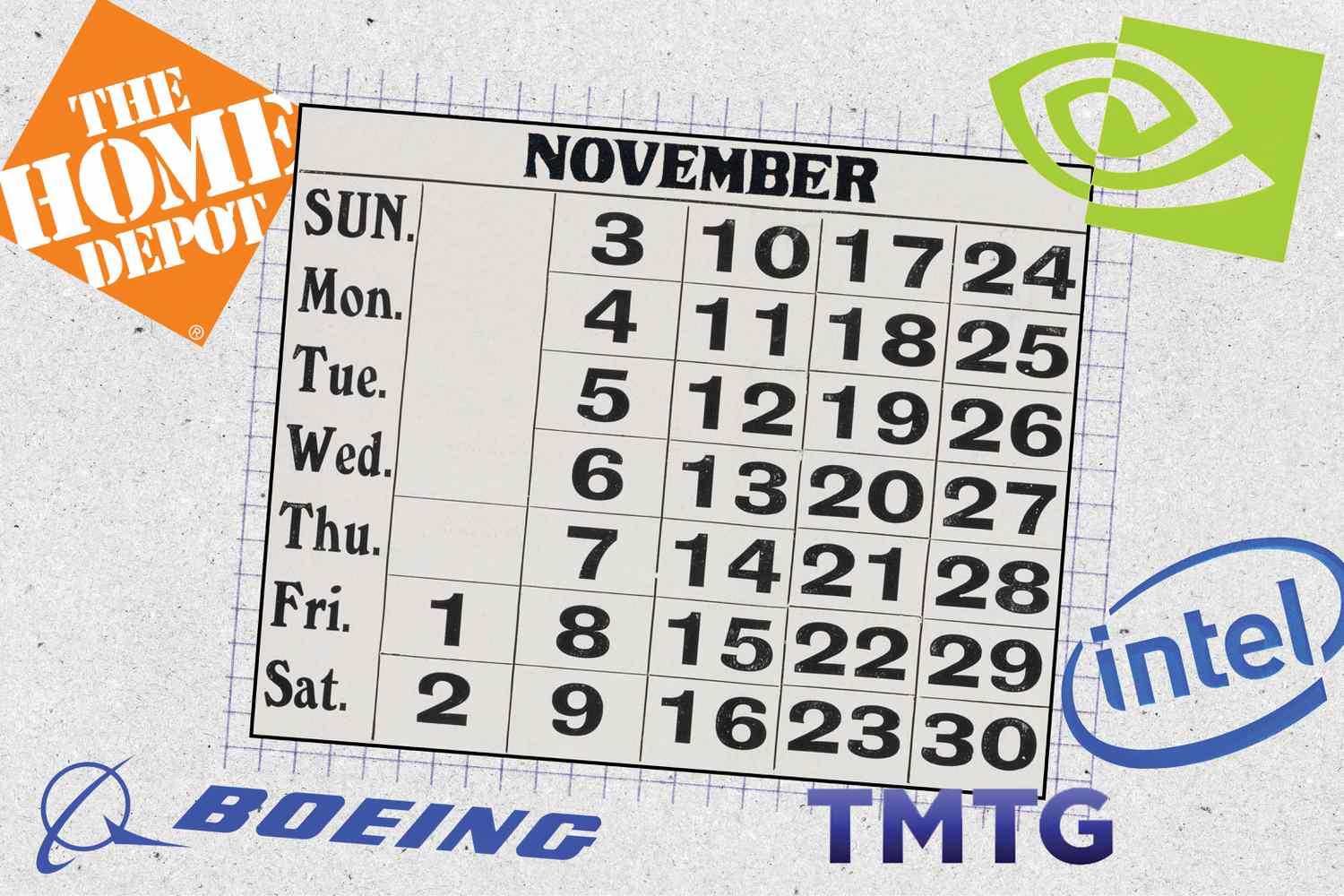

#Stocks #Watch #Novemberand #Watch

The stock market started November on a high note after falling at the close last month, while uncertainty over the US presidential election and the Federal Reserve’s next moves on interest rates hangs over the market.

Thursday’s sharp decline, led by a sell-off in technology stocks, sent major indexes into negative territory for October. The Standard & Poor’s 500 and Dow Jones indexes snapped a five-month winning streak, while the Nasdaq Composite Index failed to achieve monthly gains for the first time since July.

Q3 earnings season will end in November with some big names including Nvidia (NVDA) and Home Depot (HD). But the November 5 presidential election is likely to dominate headlines and move markets deeper this month. Below, we take a look at some stocks that could see big price moves.

Nvidia

Nvidia is scheduled to report its third-quarter results on November 20, and investor attention will be squarely focused on the world’s largest chip company in the lead-up to those results.

Analysts are overwhelmingly optimistic about the long-term potential of Nvidia stock, which nearly 4 in 5 analysts rate as a “buy,” according to Wall Street Journal Data. Bank of America (BofA) analysts in a recent note described Nvidia as a “generational opportunity,” citing its dominant position within an artificial intelligence (AI) acceleration market that they expect to quadruple in size to $280 billion by 2027.

U.S. cloud providers are expected to spend more than $200 billion on infrastructure this year, with much of that spending going toward data centers and chips that train and manage artificial intelligence models. Nvidia, which has an estimated 80% share of the AI chip market, is by far the biggest beneficiary of this spending.

Nvidia stock has gained nearly 170% this year after rising more than 200% last year. But with the stock’s stellar performance came high expectations. Shares fell more than 6% the day after Nvidia easily beat second-quarter earnings estimates in late August.

Trump Media and Technology Group

The daily movement of Trump Media & Technology Group (DJT) shares has effectively become a proxy for the odds of former President Donald Trump returning to the White House in January. No other stock is widely viewed as an indicator of voter sentiment, and no other company’s fortunes depend so directly on the results of the November election.

Stocks more than doubled in value in October, as polls showed Trump closing the gap with Vice President Kamala Harris in national polls. In the lead-up to November 5, DJT’s share price will likely continue to mirror the betting odds on popular platforms like PolyMarket, PredictIt, and, until Monday, even Robinhood (HOOD).

Given how close the polls suggest the election will be, the DJT is likely to remain volatile, especially if legal challenges to the results emerge in courts across the country.

Home Depot

Home improvement retailer Home Depot is scheduled to report its quarterly earnings in the middle of the month, and investors are hoping the results contain signs of a turnaround in the U.S. housing market.

Mortgage rates fell steadily throughout most of the third quarter, falling from about 7% on average in early July to 5.9% in mid-September when the Federal Reserve began cutting its benchmark interest rate.

New home listings hit a three-year high in September 2024, according to data from Realtor.com, as interest rate cuts and optimism eased the “stabilizing effect” of higher interest rates. At the end of September, there were more homes for sale than at any other time since April 2020. That could bode well for Home Depot, whose business depends largely on homeowners making improvements before listing.

However, a rise in the 10-year Treasury yield has pushed mortgage interest rates higher in recent weeks. Wall Street tempered its expectations that the Federal Reserve will continue to cut interest rates aggressively this year and next. Uncertainty over the presidential election and the impact of each candidate’s policies on the economy also contributed to higher returns. Rising revenues could cloud Home Depot’s outlook, as happened with homebuilder D.R. Horton (DHI), whose stock fell when its earnings guidance fell short of estimates.

Home Depot shares are up about 15% so far this year.

Intel

No company in the Dow Jones Industrial Average has had a tougher year than Intel (INTC). The once-dominant US chipmaker has struggled to maintain its technological edge over international rivals, and is now in the middle of a major turnaround effort.

Intel shares have lost more than 50% of their value this year, as the chipmaker reported massive losses — $16 billion in the third quarter alone — stemming from slowing demand for computer chips and big expenses at its chip foundry business. The company’s limited exposure to artificial intelligence also weighed on sentiment.

CEO Pat Gelsinger has implemented a $10 billion cost-cutting plan, which includes laying off about 15% of the company’s employees and suspending its dividend. Intel’s third-quarter results indicate that the efforts are starting to pay off. The company beat estimates with its quarterly revenue and sales forecasts.

However, with the company appearing in tatters, the vultures are circling. Qualcomm (QCOM) has reportedly considered making a bid for at least some of Intel’s assets. Alternative asset management firm Apollo Global Management has reportedly offered the company a $5 billion investment.

The presidential election will have consequences for US trade policy and Sino-US relations, both of which are as important to Intel as they are to its main rival, Taiwan Semiconductor Manufacturing (TSM). Trump recently pledged to impose tough tariffs on semiconductors made in Taiwan to support American manufacturers such as Intel.

Boeing

Boeing’s (BA) 2024 plan was about as rough as Intel’s.

The plane maker’s stock has fallen 40% this year as it deals with the fallout from a door plug explosion in early January. The company has spent billions of dollars in efforts to reorganize its operations and revive its public image.

Boeing’s problems worsened in September when more than 30,000 unionized employees went on strike, a walkout that analysts estimate cost Boeing up to $100 million a day. Negotiators at the end of October reached a tentative contract agreement that included a 38% pay increase over the next four years, an enhanced 401(k) match, and a $12,000 endorsement bonus. The proposal does not reinstate Boeing’s defined benefit pension plan, a key demand of workers.

Boeing recently raised more than $21 billion through a public stock offering aimed at helping the company weather the strike, which has hampered manufacturing and, depending on the outcome of a union vote on Nov. 4, could extend into its third month in November.

Analysts described the end of the strike as a “clearing event” that could pave the way for Boeing’s turnaround.

#Stocks #Watch #Novemberand #Watch