#Todays #Refinance #Rates #State #Nov

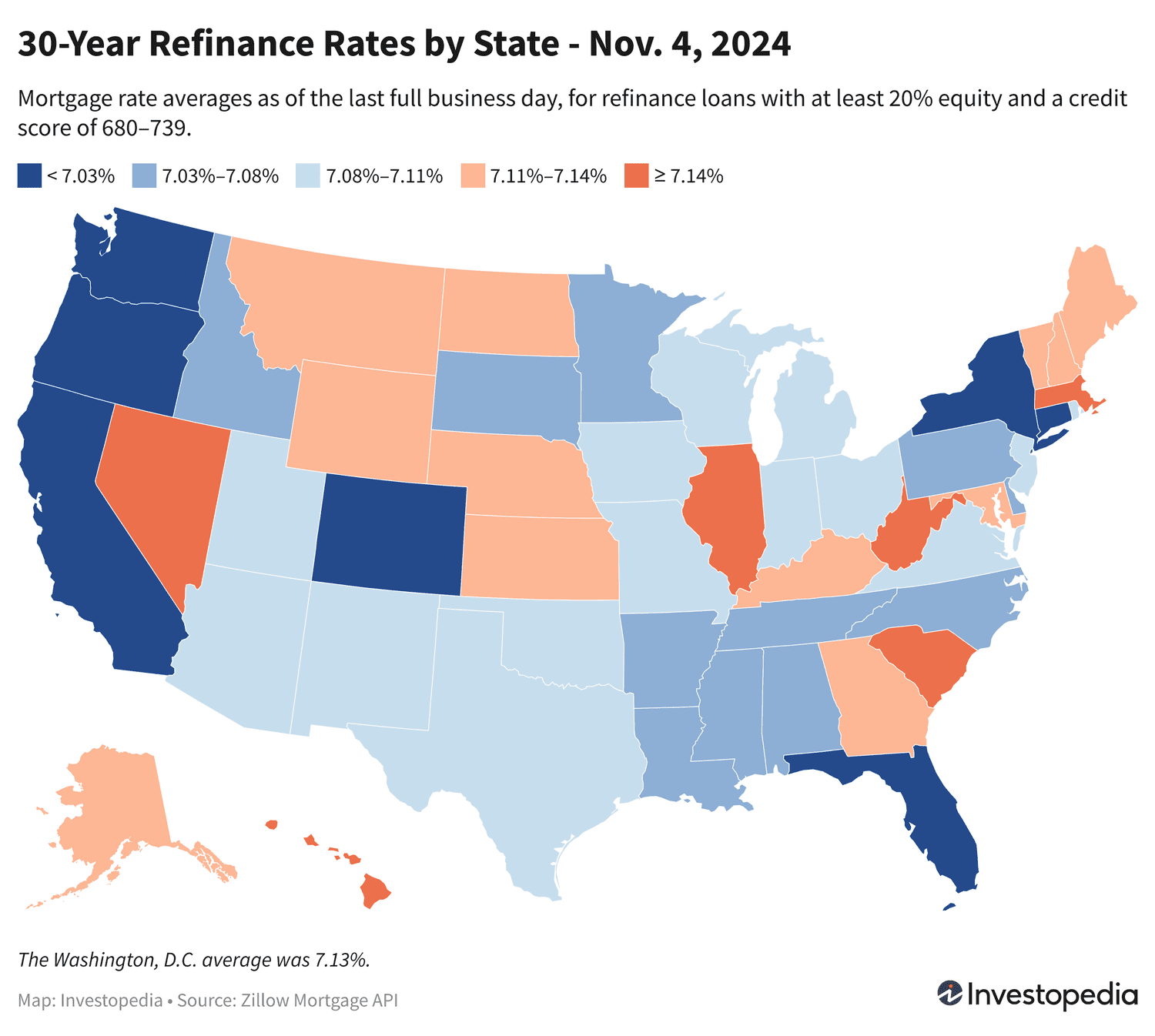

The states with the cheapest 30-year mortgage refinance rates on Friday were New York, California, Oregon, Colorado, Connecticut, Washington and Florida. These seven states posted 30-year refinancing averages between 6.90% and 7.02%.

Meanwhile, the states with the highest refinancing rates on Friday were Massachusetts, Illinois, West Virginia, South Carolina, Hawaii and Nevada. The range of 30-year refinancing averages for these states was 7.14% to 7.19%.

Mortgage refinancing rates vary depending on the state in which you originate. Different lenders operate in different areas, and rates can be affected by state-level differences in credit score, average loan size, and regulations. Lenders also have different risk management strategies that affect the rates they offer.

Since rates vary widely between lenders, it’s always smart to research your best mortgage option and compare rates regularly, no matter what type of home loan you’re seeking.

important

The prices we publish will not be directly compared to the teaser prices you see advertised online as these prices are handpicked as the most attractive versus the averages you see here. Incentive rates may involve paying points up front or you may rely on a hypothetical borrower with a very high credit score or for a smaller loan than usual. The rate you’ll ultimately secure will depend on factors like your credit score, income, and more, so it could differ from the averages you see here.

National Mortgage Refinancing Rate Averages

The national average for 30-year mortgage refinancing loans rose another 3 basis points on Friday, to 7.08%, its highest level since early August. The current average is also more than one percentage point higher than mid-September, when the average fell to a 19-month low of 6.01%. However, refinancing rates on 30-year mortgages are lower than they were earlier this summer when they started in July in the average 7% range.

| National averages of lenders’ best mortgage rates | |

|---|---|

| Loan type | Average refinancing rate |

| 30 years fixed | 7.08% |

| FHA 30-year fixed loans | 6.29% |

| 15 years fixed | 5.93% |

| Consistent jumbo for 30 years | 6.94% |

| 5/6 cubit | 7.67% |

| It is provided via the Zillow Mortgage API | |

Calculate monthly payments for different loan scenarios with our mortgage calculator.

What causes mortgage rates to rise or fall?

Mortgage rates are determined by a complex interaction between macroeconomic and industry factors, such as:

Since any number of these factors can cause fluctuations simultaneously, it is generally difficult to attribute any change to a single factor.

Macroeconomic factors kept the mortgage market relatively low through most of 2021. In particular, the Federal Reserve has been buying billions of dollars in bonds in response to economic pressures caused by the pandemic. Bond purchasing policy is a major influence on mortgage rates.

But starting in November 2021, the Fed began gradually reducing its bond purchases, making significant monthly cuts until reaching net zero in March 2022.

Between then and July 2023, the Fed aggressively raised the federal funds rate to combat decades-long high inflation. While the federal funds rate can affect mortgage rates, it does not do so directly. In fact, the federal funds rate and mortgage rates can move in opposite directions.

But given the historical speed and size of the Fed’s interest rate increases in 2022 and 2023 — raising the benchmark rate by 5.25 percentage points over 16 months — even the indirect effect of the federal funds rate resulted in a significant upward impact on mortgage rates on Over the past two years. Years.

The Fed has kept the federal funds rate at its peak level for about 14 months, starting in July 2023. But at its last meeting, the central bank announced its first rate cut in what is expected to be a series of cuts in 2024 and likely 2025. The first reduction was 0.50 percentage points.

The Fed’s next interest rate will be announced on November 7.

How we track mortgage rates

The above national and state averages are provided as is via the Zillow Mortgage API, assuming a loan-to-value (LTV) ratio of 80% (i.e. a down payment of at least 20%) and an applicant’s credit score in the range of 680-739. The resulting rates represent what borrowers should expect when receiving quotes from lenders based on their qualifications, which may differ from advertised teaser rates. © Zillow, Inc., 2024. Use subject to Zillow’s Terms of Use.

#Todays #Refinance #Rates #State #Nov