#Trump #Media #Stock #Prediction #Markets #Move #Eve #Election #Day

Key takeaways

- Trump Media stock ended Monday higher as volatility in the stock continues ahead of Tuesday’s presidential election.

- Some investors turned to prediction markets, while others looked to cryptocurrency markets, with Bitcoin falling from its highs last week.

Shares of Trump Media and Technology Group (DJT) closed higher Monday, paring earlier losses to extend a volatile trading period for the company that has become a barometer of investors’ mood ahead of Election Day.

The company, Truth Social’s parent company owned by former President Donald Trump, is far from the only way to bet on the election. Some investors turned to prediction markets, while others looked to cryptocurrency markets. Trump Media was recently a prime example of tomorrow’s action.

Trading on little company news, last week the stock rose 40% above the previous week’s close and fell more than 20% below it. Trading in the stock was halted several times along the way, and the multibillion-dollar company’s market value fluctuated.

The stock continued its back-and-forth trading on Monday, ending the day up nearly 12% to more than $34.

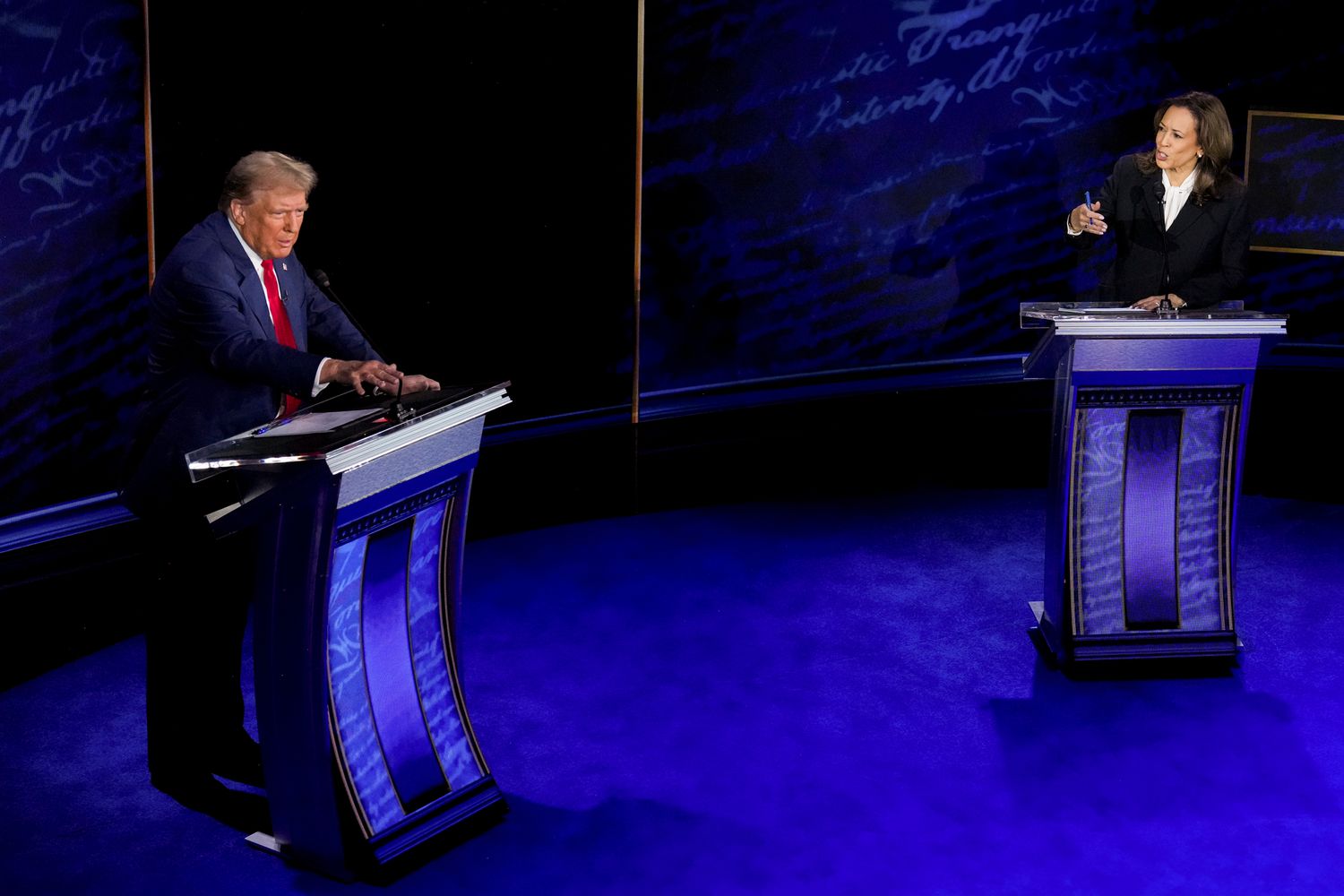

Recent polls seen by some analysts as beneficial for Trump’s main opponent, Vice President Kamala Harris, may have changed some traders’ bets earlier in the session — a dynamic also seen in prediction markets that, though generally indicate belief in a Trump victory. However, it has also moved somewhat toward Harris in recent days.

Bitcoin (BTC), which has outperformed the S&P 500 in recent months, recently retreated from its recent highs; Investors generally see Trump as more friendly to cryptocurrencies, although Harris has also indicated support for the industry.

Bitcoin has been trading at just under $68,000 recently, more than $5,000 below its highs last week.

Some individual stocks have also become particularly tied to the election outcome. Tesla ( TSLA ) CEO Elon Musk is an outspoken Trump supporter, and Wedbush analyst Dan Ives, who has an “outperform” rating on the electric car maker’s shares, suggested a range of election scenarios that could impact the stock. These include the potential for a trade war with China that could impact Tesla’s sales in that market but also a more hospitable environment for the company’s autonomy initiatives, Ives said in a note on Sunday.

If you’re interested in the policies an election might produce, rather than or in addition to betting on election results, here you are Investopedia Summaries of the economic policies adopted by Trump and Harris.

#Trump #Media #Stock #Prediction #Markets #Move #Eve #Election #Day