#U.S #National #Debt #Year

| End of the fiscal year | Debt (in billions, rounded) | Major events by presidential period |

|---|---|---|

| 1929 | $17 | Market crash |

| 1930 | $16 | The Smoot-Hawley Tariff Act reduced trade |

| 1931 | $17 | Drought rages in the dust bowl |

| 1932 | $20 | Hoover raised taxes |

| 1933 | $23 | The New Deal increased GDP and debt |

| 1934 | $27 | |

| 1935 | $29 | Social security |

| 1936 | $34 | Tax increases renewed the Great Depression |

| 1937 | $36 | The Third New Deal |

| 1938 | $37 | The dust bowl is over |

| 1939 | $40 | Depression is over |

| 1940 | $43 | Franklin Roosevelt increased spending and raised taxes |

| 1941 | $49 | The United States entered World War II |

| 1942 | $72 | Defense tripled |

| 1943 | $137 | |

| 1944 | $201 | Bretton Woods Agreement |

| [1945[1945 | $259 | World War II has ended |

| 1946 | $269 | Truman’s first-quarter budgets and the recession |

| 1947 | $258 | cold war |

| 1948 | $252 | recession |

| 1949 | $253 | recession |

| 1950 | $257 | The Korean War boosted growth and debt |

| 1951 | $255 | |

| 1952 | $259 | |

| 1953 | $266 | Recession when the war ended |

| 1954 | $271 | Eisenhower Budgets and the Recession |

| 1955 | $274 | |

| 1956 | $273 | |

| 1957 | $271 | recession |

| 1958 | $276 | Eisenhower’s second term and recession |

| 1959 | $285 | The Federal Reserve raised interest rates |

| 1960 | $286 | recession |

| 1961 | $289 | Bay of Pigs |

| 1962 | $298 | JFK budgets and the Cuban Missile Crisis |

| 1963 | $306 | US aids Vietnam; JFK was killed |

| 1964 | $312 | LBJ Budgets and the War on Poverty |

| 1965 | $317 | The United States entered the Vietnam War |

| 1966 | $320 | |

| 1967 | $326 | |

| 1968 | $348 | |

| 1969 | $354 | Nixon took office |

| 1970 | $371 | recession |

| 1971 | $398 | Wage price controls |

| 1972 | $427 | Stagflation |

| 1973 | $458 | Nixon ended the gold standard. OPEC oil embargo |

| 1974 | $475 | Watergate; Nixon resigns. A budget process has been created |

| 1975 | $533 | The Vietnam War is over |

| 1976 | $620 | Stagflation |

| 1977 | $699 | Stagflation |

| 1978 | $772 | Carter budgets and the recession |

| 1979 | $827 | |

| 1980 | $908 | Fed Chairman Volcker raises interest rates to 20% |

| 1981 | $998 | Reagan cut taxes |

| 1982 | $1,142 | Reagan increased spending |

| 1983 | $1,377 | Unemployment rate 10.8% |

| 1984 | $1,572 | Increase defense spending |

| 1985 | $1,823 | |

| 1986 | $2,125 | Reagan cut taxes |

| 1987 | $2350 | Market crash |

| 1988 | $2,602 | The Federal Reserve raised interest rates |

| 1989 | $2857 | Savings and loan crisis |

| 1990 | $3,233 | The first Iraq war |

| 1991 | $3,665 | recession |

| 1992 | $4,065 | |

| 1993 | $4,411 | Comprehensive Budget Reconciliation Act |

| 1994 | $4,693 | Clinton budgets |

| 1995 | $4,974 | |

| 1996 | $5,225 | Social welfare reform |

| 1997 | $5,413 | |

| 1998 | $5,526 | Long-term capital management crisis; recession |

| 1999 | $5,656 | Repeal the Glass-Steagall Act |

| 2000 | $5,674 | Budget surplus |

| 2001 | $5807 | September 11 attacks; Law to reconcile economic growth and tax exemption |

| 2002 | $6,228 | The war on terrorism |

| 2003 | $6,783 | The Jobs and Growth Tax Credit Reconciliation Act; Second Iraq War |

| 2004 | $7,379 | Second Iraq War |

| 2005 | $7,933 | bankruptcy law; Hurricane Katrina |

| 2006 | $8,507 | Bernanke heads the Federal Reserve |

| 2007 | $9,008 | Banking crisis |

| 2008 | $10,025 | bank bailouts; quantitative easing (QE) |

| 2009 | $11,910 | The cost of the rescue is $250 billion; The American Recovery and Reinvestment Act (ARRA) added $242 billion |

| 2010 | $13,562 | ARRA added $400 billion; The payroll tax holiday is over; Obama tax cuts; Affordable Care Act; Simpson-Bowles debt reduction plan |

| 2011 | $14,790 | The debt crisis, recession and tax cuts reduced revenues |

| 2012 | $16,066 | Fiscal cliff |

| 2013 | $16,738 | isolation. Government shutdown |

| 2014 | $17,824 | Quantitative easing program has ended; Debt ceiling crisis |

| 2015 | $18,151 | Oil prices fell |

| 2016 | $19,573 | Britain’s exit from the European Union |

| 2017 | $20,245 | Congress raised the debt ceiling |

| 2018 | $21,516 | Trump tax cuts |

| 2019 | $22,719 | Trade wars |

| 2020 | $26,945 | Covid-19 and the recession |

| 2021 | $28,428 | COVID-19 and the American Rescue Plan Act |

| 2022 | $30,928 | Inflation reduction law |

| 2023 | $33,167 |

Source: US Department of the Treasury

Debt to GDP ratio

The debt-to-GDP ratio is the ratio of a country’s public debt to its GDP.

Looking at a country’s debt compared to GDP is like a lender looking at someone’s credit history – it reveals how likely a country is to repay its debts.

The debt-to-GDP ratio is usually expressed as a percentage, and is used as a reliable indicator of a country’s economic situation, because it compares what a country owes to what it produces, which in turn shows its ability to repay debts. The higher a country’s debt-to-GDP ratio, the less likely the country is to repay its debt. This also puts the country at greater risk of default, which is of concern to investors because it could cause financial panic in domestic and international markets.

According to a study conducted by the World Bank, countries with a debt-to-GDP ratio exceeding 77% for a long period will witness a significant slowdown in economic growth. As of the second quarter of 2024, the US debt-to-GDP ratio is 121.57%. The debt-to-GDP ratio in the United States has risen to more than 77% since 2009, following the financial crisis that began in 2007.

The chart below shows the debt-to-GDP ratio for the United States from 1966 to the second quarter of 2024.

Do not confuse the terms debt and deficit. While they may look similar, they are separate. Debt is the total amount a government owes to its creditors, including budget deficits and surpluses.

Types of debt included in the national debt

There are different types of debt that make up the national debt. We’ve highlighted some of them below.

Marketable and non-marketable securities

Marketable securities such as Treasury bills, bonds, securities, and Treasury Inflation Protected Securities (TIPS) can be traded in the secondary market, and their ownership can be transferred from one person or entity to another.

Nonmarketable securities, which include savings bonds, government bond series, and state and local government series, cannot be sold to other investors.

Debts held by the public

US federal debt is owned mainly by the American public, followed by foreign governments, US banks, and investors. This portion of debt held by the public does not include U.S. debt held by the federal government or domestic government debt. Debt held by the public includes individuals, corporations, state or local governments, Federal Reserve Banks, foreign investors, governments, and other entities outside the United States government.

98.65%

The US national debt has risen since 2014. One of the main reasons for the jump in overall federal debt was increased funding for programs and services during the COVID-19 pandemic.

Intergovernmental debt

Internal government debt is debt held by the government itself. This is what one part of the government owes to another part.

Domestic government debt has not increased as sharply as general debt over the past decade because it mainly includes debt on surplus federal program revenues invested in Treasury debt.

The US national debt does not include debts incurred by state and local governments, or personal debts incurred by individuals such as credit cards and mortgages.

Tracking, maintaining and managing the national debt

The Bureau of the Fiscal Service provides accounting and reporting services to the government and manages all federal payments and collections. One of the main roles of the financial service is to track and report on the national debt.

Like the rest of us, the federal government also charges interest on borrowing money. The amount of interest the government pays depends on the total national debt and the interest rates on various securities. When the target range for the federal funds rate (Fed funds rate) is increased by the Federal Open Market Committee (FOMC), carrying debt becomes more expensive for the government as well.

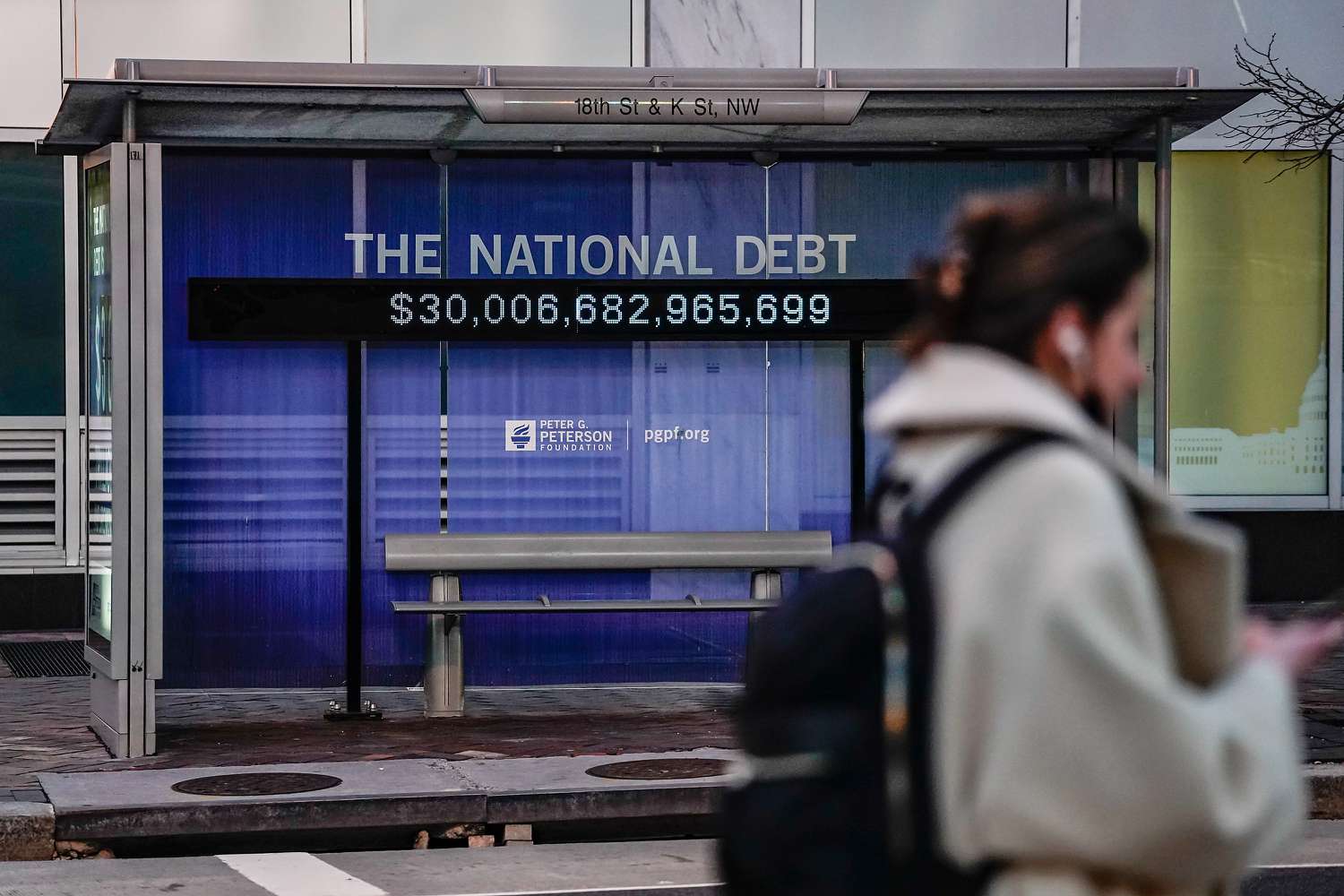

Interest expenses have been relatively stable despite debt rising every year over the past decade, thanks to low interest rates. However, when interest rates rise, it becomes more expensive to maintain the national debt. With the Fed raising interest rates repeatedly in 2022 and 2023 to cool high inflation, the United States could pay up to $1 trillion more in interest payments on the national debt this decade, according to the Peter J. Peterson Foundation.

The Treasury Department’s primary goal when managing the national debt is to ensure that the federal government can borrow at the lowest cost over time. The Treasury does this by offering marketable securities that are attractive to a wide range of investors because they are safe and liquid.

Constantly changing financial markets, uncertainty about future borrowing needs, and debt limits make Treasury’s debt management efforts difficult.

The Treasury needs to consider the amount of securities it offers to investors in the context of what is happening in the financial markets and prepare for policy changes and economic events that could significantly impact the Federal Reserve’s cash flow and borrowing needs.

Debt ceiling

The debt ceiling, or debt limit, is the maximum amount the U.S. government can borrow by issuing bonds. When the debt ceiling is reached, the Treasury must find other ways to pay expenses.

If what the federal government owes reaches the debt limit, and that limit is not raised, there is a risk that the United States will default on its debt. This sounds like alarm bells for investors as this could have serious consequences on the national and global markets. To avoid the risk of default, the debt ceiling must be raised by Congress, which has happened many times.

In January 2023, US Treasury Secretary Janet Yellen announced that the US government had reached its debt ceiling. Yellen said the US government would take “extraordinary measures” to prevent a sovereign debt default, which could occur in mid-2023 if the debt ceiling is not raised or eliminated completely.

The extraordinary measures authorized by Congress would temporarily suspend some domestic government debt, allowing the Treasury Department to borrow more money for a limited period of time. The debt ceiling was last raised to a record $31 trillion in late 2021 — a limit that has now been reached — by President Joe Biden and Congress. In June 2023, an agreement was reached between Democrats and Republicans to suspend the debt ceiling and allow more spending through 2025.

How much does the United States pay off its debt each year?

Paying or servicing the national debt is one of the federal government’s largest expenditures. According to the Congressional Budget Office, net interest payments on federal debt were $659 billion in 2023 and are expected to rise to $870 billion in 2024.

What is the current American debt?

As of October 2024, the US national debt is more than $35.85 trillion.

When was the US national debt the highest?

Looking at the national debt in terms of debt-to-GDP ratio, federal debt rose to an all-time high of 132.96% in the second quarter of 2020 due to the pandemic-fueled recession.

Bottom line

The national debt is the total amount of money a country owes to its creditors. The government spends money on programs such as health care, education, and Social Security, and accumulates debt by borrowing to cover the remaining balance of expenses incurred over time. Major economic and political events, such as recessions, wars, or epidemics, can affect government spending.

#U.S #National #Debt #Year